A Banker's Gonna (Make) Bank

Part 3/5: Perhaps there's an exception to the generalisation that making it into the upper echelons of the banking world implies adherence to "the pursuit of wealth and the maximization of profit". If so, it would appear that Mark Carney is not that exception.

Table of Contents

Daddy knows best?

With it being cleared up in part one and part two that Carney was neither "benevolent daddy" nor "malevolent daddy" (coming off a supporter having effectively called Carney "daddy" after she yelled out "Lead us big daddy!" at an election rally), it turns out that Carney actually isn't the biggest daddy on the block either, NATO secretary general Mark Rutte having literally called US president Donald Trump "daddy" at the recent NATO Summit in The Hague. But while Rutte later cleared things up by stating that Trump wasn't so much "daddy" but rather was a kind of father figure to Europe (it'd be fair to surmise that Rutte and company have to do what they can to try and keep Trump somewhat onside, which may actually be a fool's errand), it should also be cleared up that although Carney comes with a rather deep resume, he may not actually have the specific knowledge required to properly address the threats to Canada's sovereignty as well as the parallel predicaments that will inevitably arise in tandem. Are arising in tandem.

Throughout the recent federal election Canadians were of course widely reminded of Carney's economic bona fides, but according to a 2021 Guardian article it turns out that at one point Carney apparently desired to become a marine biologist. However, having amassed a slew of student loans during his time at Harvard, the most effective way he envisioned himself being able to pay off those loans was to enter the world of finance. So a career as a banker it was. Carney ultimately spent 13 years at the investment bank Goldman Sachs, likely earning a tidy sum while working at its offices in London, Tokyo, New York and Toronto.

In 2003 Carney left the private sector for the public sector, starting off as a deputy governor at the Bank of Canada (BoC) before becoming senior associate deputy minister at the Department of Finance Canada in 2004. Come February 1st 2008, on what turned out to be the eve of the Global Financial Crisis (GFC), Carney superseded other more qualified candidates and was appointed governor of the BoC. During what was seen to be a widely successful stint in Ottawa, Carney was headhunted by then-chancellor George Osborne to become the next governor of the Bank of England (BoE), commencing the position on July 1st 2013 (and staying until he left in March of 2020) with the notable introduction of being lauded as the "rock star of central banking".

But while Carney has been widely credited with assisting Canada in avoiding the worst effects of the GFC (unlike other countries, none of Canada's banks collapsed and its economy returned to growth much quicker than others), not only might some of the hype be misplaced, but for those of us in the know it would appear that Carney doesn't understand what the underlying cause of the GFC was. That being so (of which will be fully explained in the fourth and final part of this series), if we Canadians are to have Carney as our point man against the encroaching United States then we ought to be fully informed about any blind spots the new prime minister may come with, what effect those blind spots may have on the approaches he may take, and what Canadians might want to do in light of all that.

Before elaborating on the above in the follow-up piece to this third part, in order to better understand Carney's thinking a few words shall first be relayed describing how conventional of a banker he appears to be.

Dodging talk about tax dodging

As virtually every Canadian knew, the recent federal election was essentially a race between two parties (and their leaders): the left-of-centre Liberal Party led by former (central) banker Mark Carney versus the right-of-centre (but increasingly populist-right/alt-right) Conservative Party led by career politician Pierre Poilievre. Understanding the gravity of the matter (the threat of a MAGA-aligned federal party coming to power in Canada), a significant amount of Canadians sympathetic to third parties (predominantly the NDP, Bloc Québécois, and Greens) overwhelmingly decided to bite the bullet by abandoning their preferred choice for the lesser evil of Mark Carney and the Liberals.

The "lesser evil"?

Well, yes. Prior to his stints at the BoC and the BoE Carney was after all a banker at Goldman Sachs, after which he held several positions in both the public and private sectors, including chair of Bloomberg L.P., Special Envoy on Climate Action and Finance at the UN, co-chair of the World Bank's private sector investment lab and, amongst other positions, was – as of October 2020 and up until he ran for the Liberal leadership – also chair and head of impact investing at Brookfield Asset Management.

While Brookfield isn't exactly a household name, it does nonetheless manage more than US$1tn in assets, making it not only one of Canada's largest publicly traded companies but one of the world's largest investment firms. Some of those assets are in various mining, infrastructure and insurance companies, casinos, lotteries and sports-betting ventures, and more. While its hundreds of billions of dollars in real estate ownership include such notable developments as New York City's Hudson Yards as well as London's Canary Wharf, Brookfield is also one of the largest residential property owners in the US and Canada.

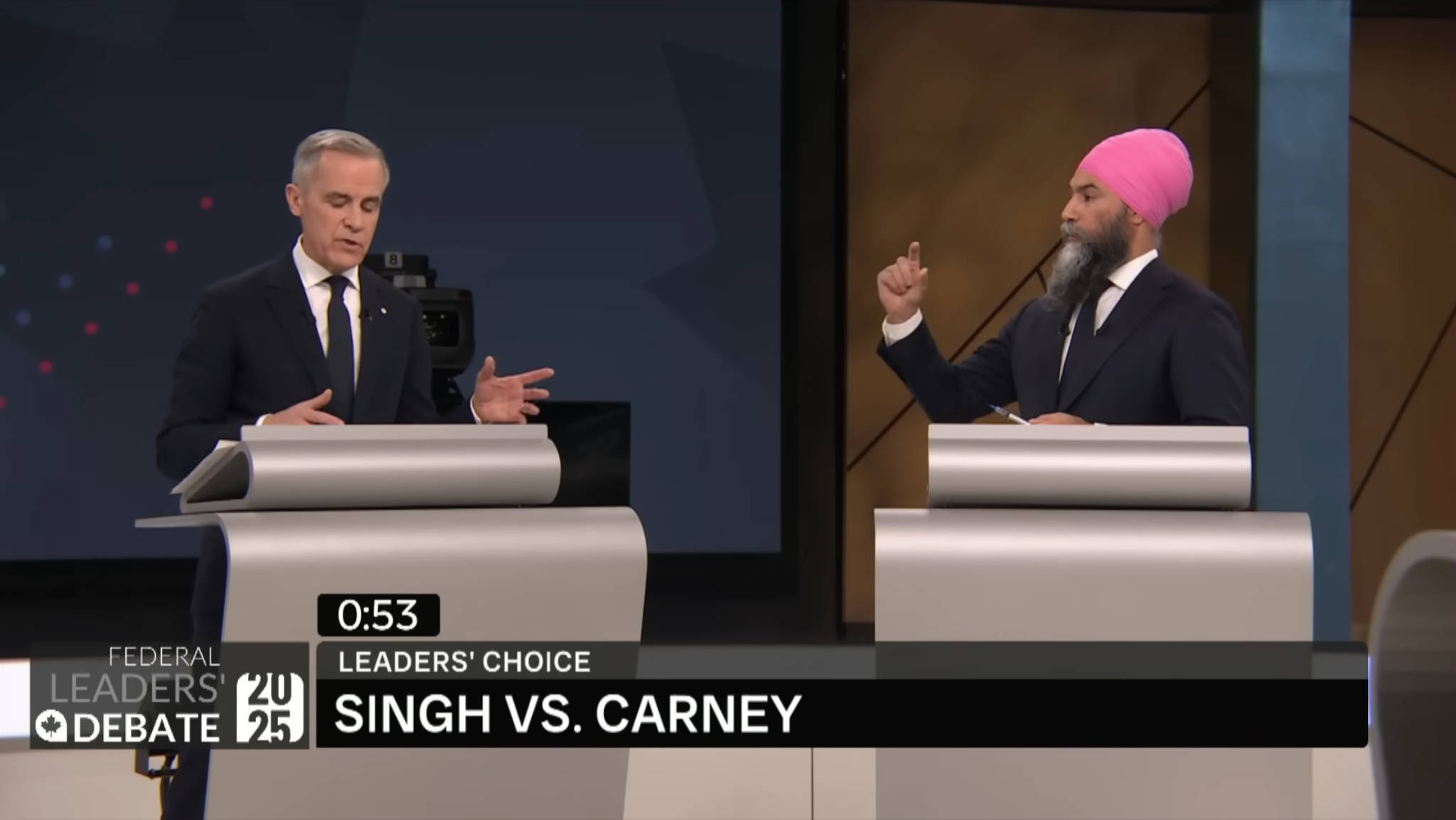

A 2024 annual report pointed out that Brookfield controls 73,337 single family lots and 220 multi-family, industrial and commercial serviced parcel acres in both the US and Canada. As then-NDP leader Jagmeet Singh said to Carney during the leadership debate, "As chair, you approved decisions where Brookfield bought up affordable homes, kicked out the tenants, and jacked up the rents". That 31,211 of Brookfield's jacked-up-in-rent 73,337 lots are in Canada (at a time when Canada and much of the rest of the world is in the midst of a housing crisis) might not come off as a very good look for the highly profitable corporate landlord in the eyes of struggling Canadians.

To make matters worse, two-thirds of Brookfield's revenue emanate from private equity, which in this case entails the vampiric takeover of valuable companies, companies in which as many jobs as possible are eliminated and which after being stripped for parts have those pieces sold off to the highest bidder. In a similar fashion, Brookfield also operates in the field of credit (particularly distressed securities), a sector in which it buys up debt with the intent of reorganizing or liquidating the debtor in order to turn a profit. As the practise of trading in distressed securities implies taking advantage of the misfortune of others, those that partake in this field are generally referred to as "vulture funds". Thanks to his role at Brookfield, it's not for no reason that Carney has been called a "cutthroat capitalist" and "a man devoted to the pursuit of wealth and the maximization of profit" by Canadian magazine The Walrus.

It doesn't stop there though, Singh having also stated to Carney during the debate that "Brookfield Investments, your company, is one of the biggest tax dodgers in Canada" (a claim that wasn't acknowledged in any way whatsoever by Carney).

For starters, a 2023 report by The Centre for International Corporate Tax Accountability and Research (CICTAR) stated that Brookfield may be the number one tax avoider in Canada.

Brookfield's track record of alleged tax dodging has received some attention in Australia and Canada, where it may claim the title of Canada's top tax dodger.

How did Brookfield achieve this "esteemed" distinction? Well, by utilizing its network of more than 40 subsidiaries / shell companies registered in a variety of tax havens – including Bermuda, the Cayman Islands, Panama and Malta – Brookfield enabled itself to avoid paying Canada several billion dollars in taxes. As the NDP have highlighted, Brookfield made US$23.3bn between 2021 and 2024, years in which Carney was with the firm. With Canada's tax rate being 26.4%, Brookfield should have paid US$6.1bn in taxes. Instead, it paid only US$2bn in taxes, a shortcoming of US$4.1bn (CAD$5.3bn) in revenue that Canada missed out on.

To be clear, Brookfield didn't partake in tax evasion but rather tax avoidance, implying that what it did was in fact lawful. By utilising various structures in the tax code, billion dollar companies like Brookfield are able to hire Harvard/Oxford graduates like Carney to take advantage of loopholes (that are sometimes there for good reason, sometimes not) and via subsidiaries in tax havens can then keep billions of dollars out of the reach of tax authorities.

That Carney was able to go out on the campaign trail and proclaim how much he "care[s] about people" can come off as a bit rich considering how many livelihoods Brookfield has destroyed over the years, including during the period in which Carney was employed by the company. For as was also stated in that report by CICTAR,

Aggressive tax avoidance, whether legal or not, deprives governments of revenue desperately needed to fund essential public services – including health, education, and sanitation.

While both the Conservatives and the NDP attacked Carney on the campaign trail for his usage of offshore tax havens, Carney, while directly avoiding speaking about the ethics behind Brookfield's practices, stated that Brookfield nonetheless "follows the rules".

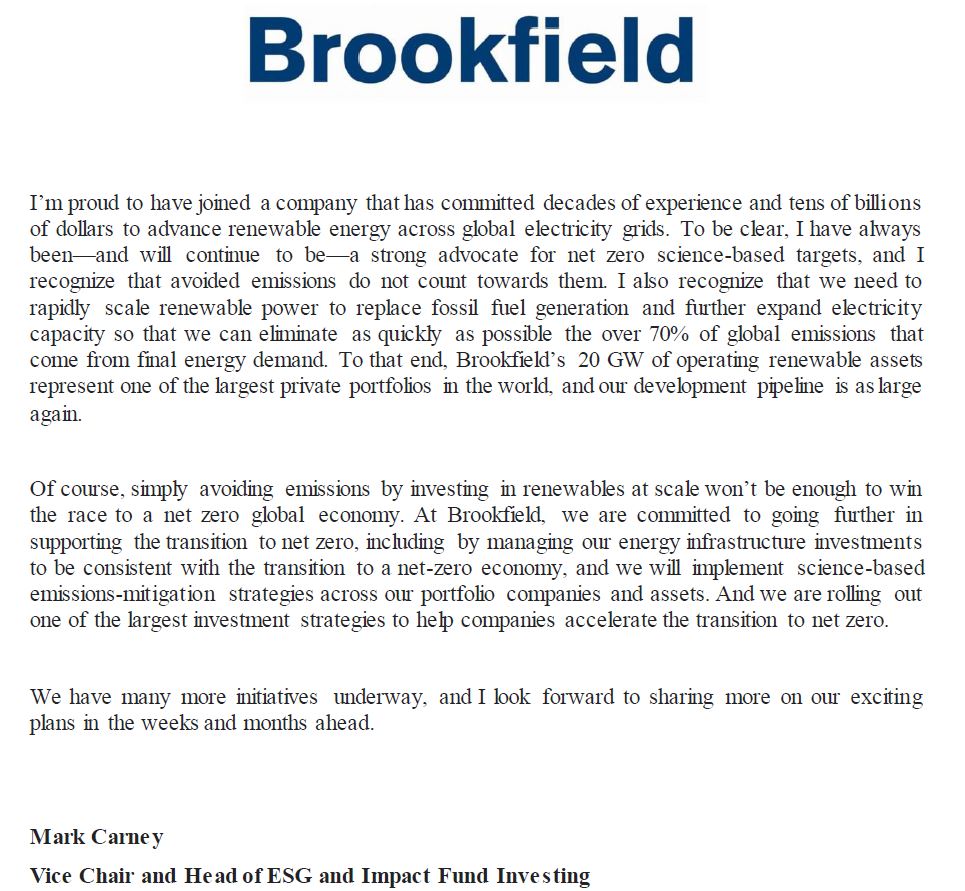

Similarly questionable was the occasion in which Carney claimed during a 2021 interview with Bloomberg that Brookfield was a net zero company. While Brookfield – which had a US$600bn portfolio at the time – not only had significant fossil fuel investments but was also the world's second-largest investor in climate-friendly businesses, Carney in turn claimed that those clean energy businesses had offset its coal, oil and gas investments. Various climate experts and environmental campaigners (such as Science Based Targets initiative and Greenpeace, respectively) called Carney out for "greenwashing", Carney eventually qualifying his claims with an acknowledgement on Twitter that having investments in renewable energy are not the same as having net zero emissions, as so-called avoided emissions "do not count towards" net zero targets.

Yes, there's a few other questionable instances in which – horror of all horrors – Carney got a few dates and the like wrong, but seeing how the far-right rags readily covered all that (whose websites and articles about this I'm not going to link to, of which are none too surprisingly run on Substack) I'll go ahead and omit it all from this piece.

In summation, with parts one and two (respectively) dismissing the adulatory and disdainful descriptions painted of Carney, and then this part three having effectively laid bare the manner in which Carney is essentially another run-of-the-mill banker ("devoted to the pursuit of wealth and the maximization of profit") with a bit of side action (his central bank governorships, work with the UN, etc.), what remains to be ascertained are Carney's shortcomings. Shortcomings that (partially based on how long he sticks around as Canada's prime minister) may have consequences that (due to Trump still making 51st state threats to Canada, and simultaneously due to the leader of the opposition Conservative Party of Canada itching to be what Alexander Lukashenko is to Vladimir Putin) may result in Canada becoming the 51st state by either de jure or de facto manner.

Part four in this series will therefore outline those aforementioned shortcomings of Carney's, while simultaneously giving a thorough explanation of the economic predicaments that by all appearances Carney doesn't seem to understand. With the fourth and final part of this series out of the way, we'll then move onto the next (related) series. But first things first.

Comments