Canada Elects its First “Big Daddy” – the Greatest Daddy Ever! (says the loopy-left)

Part 1/5: Too many Canadians (from both sides of the aisle) have been duped by false narratives about Mark Carney, something they ought to jettison if they'd prefer a proper understanding of Carney's strengths and weaknesses, an understanding that may be crucial in this time of American encroachment

“Lead us big daddy!”

In this day and age of Trump 2.0, when a week in this cognitively-offensive news-cycle can feel like an entire year's worth of mind-numbing nonsense, you'd be excused for not paying too much attention to the corner of the barrage that's been focused on US-Canada relations. On the other hand, if you're a born and bred Canadian (like yours truly) you've likely been infused with a completely unexpected jolt of patriotism, one that you've never seen – or ever expected to see – take over nearly the entire country.

The reasons for this newfound (polite) patriotism (which will only be referred to in passing in this post) are obvious enough. The domestically-maligned former prime minister Justin Trudeau announced his resignation in early-January, US president Donald Trump then threatened Canada's sovereignty and referred to it as the 51st state the very next day, followed up a couple of months later with the political neophyte (but well-connected) Mark Carney being elected as the new leader of the Canadian Liberal party (automatically designating him as Canada's latest prime minister, consecrated a month and a half later when he won the snap election he'd quickly called).

While the election was mostly a one-issue election (in which the candidate most suited to fending off American encroachment would be identified and thus chosen), not only did Canadians decide that Carney was that guy, but the jolt of (polite) patriotism got some so riled up that they decided to give Carney a new nickname.

(source: CPAC / YouTube)

While some individuals not too surprisingly lampooned the new nickname, others apparently pined for some of that "big daddy energy". Similarly, and as we'll get to in part two, while there were also those painting Carney as if he was the biggest daddy of big daddies, there were however those describing Carney as if he were some kind of evil daddy incarnate.

So while there's no consensus on exactly what kind of daddy Carney is, in a time when Canada's sovereignty is being threatened by its neighbour to the south (who some of us long ago knew would turn out to be an axe murderer and never fell for that "but he was such a nice neighbour, you'd never imagine he'd do such a thing" shtick) it'd be worthwhile to decipher what kind of daddy Carney is and isn't and, with that distinction made, decipher whether or not Canada's prime daddy can be enough to hold off the encroaching United States.

For now we'll take a look at a theory held by many of the "loopy-left", saving the theories of the "loopy-right" for part two.

Did biggest daddy Carney orchestrate a global US bond sell-off?

While the recent change in (polite) patriotism has lifted the spirits of millions of Canadians (many felt embarrassed and ashamed to wave the Canadian flag after the anti-vax/anti-lockdown "trucker/freedom convoy" co-opted it, but have now happily reclaimed the national emblem while rallying like never before), a fair amount of Canadians have found themselves perplexed in regards to deciphering the truth of whether or not their newly-minted prime minister played a role in causing US president Donald Trump to rescind his application of sky-high "Liberation Day" tariffs on much of the rest of the world. More specifically, did Carney – who happens to have previously been governor of both the Bank of Canada and then the Bank of England – actually orchestrate a US bond sell-off in order to harm the US dollar? And if so, is he, in turn, the biggest daddy of big daddies?

For those not familiar with this (supposed) chain of events, and putting Carney's (supposed) involvement aside for the moment, the story appears to have possibly formed out of a piece originally published on March 12th on Binance Square, the social media arm of the cryptocurrency exchange Binance. According to the piece, "Canada has reportedly moved to sell off $400 billion in U.S. Treasury bonds, a direct hit to America's financial stability." The internet then did its thing, social media quickly becoming awash with proclamations regurgitating claims about said sell-off.

None too surprisingly, an official with Canada's Department of Finance told The Canadian Press that, in contrast to claims of $400bn in US Treasuries being sold off, "Canada is not selling off its existing U.S. government securities".

The lifespan of that baseless and absurd claim expired soon thereafter, overtaken about a month later by a more sophisticated claim that similarly began making its own way across the internet. Although I initially ignored the source article of the newer claim when a link to it went through a social media feed of mine, when I discovered that even a family member of mine was sharing a video working off of said article, I realised that said claim probably deserved a closer look.

According to the video (by some YouTube personality named Adam Mockler), seen more than 756,000 times, liked by more than 46,000 people, and entitled no less than "Trump SCARED SH*TLESS by Canada's GENIUS PLAY!", Mark Carney had not just pulled off "the financial equivalent of a firing squad", but he'd "basically pulled a stunt out of, like, a James Bond movie". But why settle for the hyperbole of just one movie comparison, seeing how Carney's manoeuvre was also "like when Matt Damon in Good Will Hunting is just so smart that he can outwit anybody". And why settle for the hyperbole of two movies when the whole story apparently "reminds me of like Breaking Bad [...] using his financial skills and know-how to pull a trick on Trump". And why settle for the hyperbolic description of comparing things to two movies and one TV show when you can also add in reference to a card game, seeing how other countries apparently had "a reverse Uno card" along with "a metaphorical loaded gun pointed at the US"?

All of that hyperbolic drivel was working off material from the source piece (published on Substack, no less, archived link here), written by self-proclaimed "Canadian raconteur" Dean Blundell, a Torontonian with a bit of a checkered past.

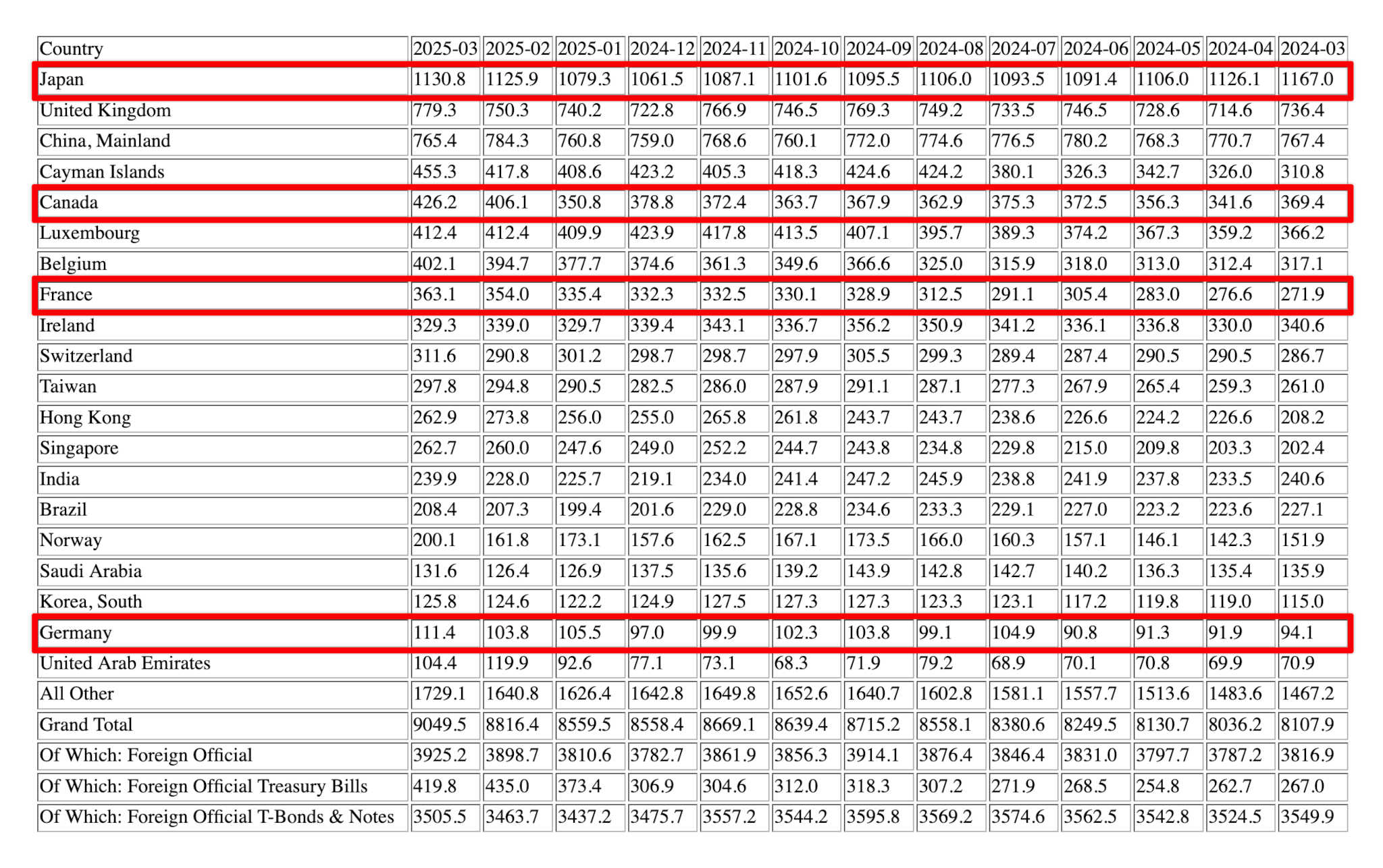

According to Blundell (whose article was published April 10th), Carney had been "quietly increasing Canada's holdings of U.S. Treasury bonds". While official records of holdings from the US Department of the Treasury currently only exist up until March of this year, and although Carney wasn't sworn in as prime minister until March 14th, it's true that Carney had been an economic advisor to Trudeau since September of 2024 (although was never part of his cabinet). That being so, Canada's holdings of US Treasury bonds bounced around between $362.9bn and $378.8bn between September and December of last year, before decreasing to $350.8bn by January of this year and then shooting up to a one-year high of $426.2bn by March. Was that (admittedly large) $75bn+ increase over the span of two months in some way a sign of Carney's meddling (during his advisory period to Trudeau, before becoming prime minister himself)? Although there's always the possibility that someone whispered something in someone else's ear, we'll now see why this was all but certainly not the case.

Giving Blundell the benefit of the doubt for the moment, the supposed reason for Carney amassing those US Treasury bonds is because bonds are essentially IOUs that governments issue to borrow money. In fact, the Government of Canada launched a five-year US$3.5bn global bond on March 11th, having similarly done so back in April of 2024. The idea behind these bonds is that investors, banks and countries buy them in order to safely park their money (while earning interest), effectively providing a loan to the issuing country in the process. The issuing country then promises to pay back the loan, with interest (a dubious system in itself, which won't be elaborated on here), over a pre-determined period of time.

While issuing-countries are thus enabled to spend more than they collect in taxes – on social security, military, infrastructure, etc. – they theoretically put themselves at risk: if owners of bonds start selling them in unison, the flood of bonds on the market causes their price to drop, which in turn results in interest rates (yields) rising in order to attract new buyers. The issuing country therefore ends up paying more in interest rates in order to borrow, potentially leading to runaway debt and a weakening dollar.

In a worst case scenario foreign goods would not only cost more due to the depreciating dollar but, as borrowing costs increase, the government would be forced to implement cuts – to the aforementioned social security, military, infrastructure, etc. – which in turn would result in fewer jobs. Increased interest rates would similarly result in fewer loans given and taken out (coinciding with companies being unable to hire), potentially leading to a self-reinforcing feedback loop and depression with crashing markets, spiking prices, and disappearing jobs.

According to Blundell it wasn't Carney's goal to cause an all out collapse of the US economy (as described above), nor to partake in anything along the lines of the aforementioned $400bn bond sale. "Not a fire sale—nothing so crude. A slow, steady bleed. A signal to the markets that the U.S. dollar's perch wasn't so secure." Moreover, Carney supposedly wasn't acting alone as Blundell also claims that Carney made his way to Europe to explain his scheme to "the EU's heavy hitters—Germany, France, the Netherlands. Japan was in the room too, listening closely." The idea behind the pitch was that if Trump did in fact follow through with his threat of tariffs, Canada wouldn't simply retaliate with its own set of tariffs but would start offloading some of its bonds in tandem with its allies.

Alongside the evidence-free claim that Carney had been quietly buying up US bonds, is there any proof of this European visit by Carney and the meeting with various world leaders? Well, while Carney wasn't sworn in as prime minister until March 14th, he did nonetheless skip the custom whereby newly-inaugurated Canadian prime ministers make their first foreign trip a visit down south to meet up with the US president. Instead, Carney opted to fly to Europe in mid-March to visit his "reliable allies" Emmanuel Macron in Paris and Keir Starmer in London, in the process stating that Canada is the "most European of the non-European countries". That being so, the timing of that trip would have been far too late for Carney to have laid out the aforementioned pitch to said "reliable allies" and to then proceed with the bond purchasing. On the contrary, Carney would've had to have made such a trip months earlier, possibly while advisor to Trudeau (but which was long before the 51st state threat had begun). Again, is there any proof of this happening? Well, although there's no proof that it didn't happen, there's no proof – or evidence given – that it did happen either.

Nonetheless, Blundell claims that Canada and its allies did in fact act in unison.

Japan, holding over $1 trillion in U.S. debt, signed on and started to sell those US Treasury bonds which scared Trump shitless. Key EU countries—collectively sitting on another $1.5 trillion—nodded in agreement. This wasn't a bluff. It was a silent pact.

So silent that we have no evidence to look to and have nothing but Blundell's word to go on. Except, that is, for a bunch of AI-generated YouTube videos posted in mid/late-March claiming that Japan was threatening to dump billions of dollars of US Treasury bonds. Thing is, while Japanese investors did in fact sell some US Treasuries in November of 2024, that trend reversed in 2024 as Japanese investors purchased nearly $20bn of US Treasuries in January, nearly $50bn more in February, and another $5bn in March (see chart above). To make matters worse for Blundell (and for the veracity of all those AI-generated YouTube videos), the day before Blundell published his article Japanese finance minister Katsunobu Kato stated that Japan wouldn't use its US Treasury holdings as a negotiating tool against Trump's tariff threats. As Reuters put it, quoting Kato,

“We manage our U.S. Treasury holdings from the standpoint of preparing for in case we need to conduct exchange-rate intervention in the future,” not from the standpoint of bilateral diplomacy, Kato told parliament.

Likewise, Japan's Liberal Democratic Party policy chief Itsunori Onodera made similar comments just a few days later.

As an ally, we would not intentionally take action against US government bonds, and causing market disruption is certainly not a good idea.

Sure, those could just be public-facing statements made by Japanese politicians, statements that could very well change the next day or which could be outright false. But even if so, the evidence still contradicts claims Blundell made in his widely-shared piece about Japan selling US Treasuries.

Nonetheless, a day after the Japanese finance minister made his statement about using its US Treasuries for exchange-rate intervention (and not for causing market disruption), Blundell stated that

[T]hreaten[ing] to pull the plug [...] was the determining factor in Trump's surrender. Not the public spats, not the retaliatory tariffs Canada slapped on U.S. autos (though those stung). It was the quiet, coordinated threat of a Treasury bond unwind that bent Trump's knee. Carney didn't need to shout. He didn't need to posture. He lined up the free world—Japan, the EU, Canada in lockstep—and showed Trump the cliff's edge. Strategic brilliance doesn't get louder than that.

As Blundell then added,

When Trump announced his tariff “pause,” it wasn't a victory lap. It was a concession. Carney moved markets without firing a shot. He gave Canada a seat at the power table and proved that global respect isn't won with bluster—it's earned with moves that hit where it hurts. Trump talks tough. Carney plays chess. And right now, the board's his.

Except that Carney didn't "move markets without firing a shot", and nor was "Carney playing chess" on "his board". If anything it was likely that Blundell was playing "let's see how many new paying Substack subscribers [at "50% off today"!] we can get with this outlandish, click-baity piece" (which would be rather par for course when it comes to that shady platform Substack), a piece that should probably be netting him a commission from clickbait-wielding YouTubers like Adam Mockler who were spreading his unsubstantiated and obviously false claims.

Because supposing you're still wavering and are holding out on the possibility that Carney truly is the biggest daddy of big daddies, you might remember my mention of Blundell having a checkered past. According to a Snopes piece also debunking Blundell's claim, Blundell has been described by The Toronto Star as being a "shock jock" (someone reliant on exaggeration and offensive comments to amass a listenership), was suspended by Toronto's 102.1 The Edge in 2013 after one controversy too many, and then in 2017 was let go from SportsNet 590 The Fan, Blundell's "sophomoric brand of humour [having] made him a controversial figure for years".

Suffice to say, all evidence suggests that Blundell's story was created out of whole cloth, and that Carney did not orchestrate – nor threaten to orchestrate – a global sell-off of US Treasuries. In fact, in a (rather humorous) interview Carney partook in in a Tim Horton's with This Hour Has 22 Minutes comedian Mark Critch, Critch actually asked Carney about the US Treasuries story. Carney, who doesn't seem to have much of a poker face but who does seem to have a healthy sense of humour, can be seen pulling off an expression akin to rolling his eyes at first mention of the nonsensical story, followed up by what looks like him trying to plead through his laughter for Critch to not spread what is effectively an absurd conspiracy theory.

(source: This Hour Has 22 Minutes / YouTube)

The reason for Carney saying that he "couldn't possibly comment"? Likely not because he was trying to be funny, but instead was likely because the Bank of Canada buys and sells US Treasuries under direction of the governor of the Bank of Canada (currently Tiff Macklem). As Carney would know (and as Blundell should know if he's gonna comment about this stuff), the Bank of Canada is independent of the Canadian federal government (similar to how the American Federal Reserve is independent from the presidency, Trump therefore not able to fire chair Jerome Powell as he'd like to do). Therefore, Carney, as prime minister, only has spending/borrowing authority through the finance department (which manages the budget). Carney in effect has no direct involvement with the Bank of Canada's day to day activities, presumably the reason for why he "couldn't possibly comment". Carney's comment to Critch therefore wasn't a denial so much as it was something along the lines of a "you'd have to ask Tiff Macklem, as that's now out of my realm".

All in all, no, Carney isn't the biggest big daddy of them all.

And Blundell? Well, I've learned to ignore him. (And I certainly don't monetarily contribute to his Substack newsletter.)

So while it should now be clear that Carney isn't the biggest of benevolent big daddies, there are however those that see Carney as being the biggest of malevolent big daddies. Not because of his experience as governors of the Bank of Canada and the Bank of England, nor even because of his history with Goldman Sachs, but rather because of his association with institutions such as – please make sure your tinfoil hat is well affixed – the World Economic Forum.

Stay tuned for parts two and three. (And then part four, where we'll start to get into the thick of things.)

Comments